Step by Step apply for HSRP in Maharashtra India - For different district passing plate or registration number

Sometimes you did not have clarity on anything from respective thing directly. But it gets true based on someones experience.This blog Unsaid Facts or we can say Unspoken Truth is to provide information about the facts in our society, government which surprisingly comes into picture. Be alert and if you have any unexpected experience and want to share, please write it to me.

blockcopy

Tuesday, July 29, 2025

Step by Step apply for HSRP in Maharashtra India - For different district passing plate or registration number

Friday, July 25, 2025

File India Income tax ITR 2 step by step - Continued #2

File India Income tax ITR 2 step by step - Continued #2

Schedule Chapter VI-A

Section 80C

Part B will have all the deduction to show. 80C will be auto populated. If not then you will have to update schedule 80C first with all investment details. schedule 80C is present in all schedules list.

File India Income tax ITR 2 step by step - Continued

File India Income tax ITR 2 step by step - Continued

Schedule Capital Gain -

select A(i) Short-term capital gains - number 2 below declare collective amount of buy and sell. Check AIS for more details

Edit to add insurance paid for your family members, you can declare preventive health check upto Rs. 5000

File India Income tax ITR 2 step by step

File India Income tax ITR 2 step by step

Note - Do not switch from old regime to new regime to check tax value. It will wipe out your old regime investment details. Instead prefer to check new regime tax amount through external sites like cleartax.

1. ITR 2 filing is done by salaried employees who have multiple properties and capital gain income from investments.

Follow the screenshots.

Sunday, July 13, 2025

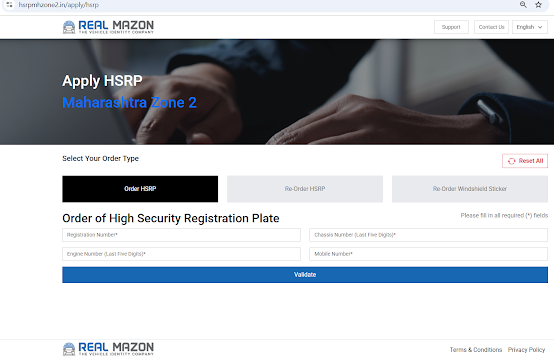

Step by Step apply for HSRP in Maharashtra India

Step by Step apply for HSRP in Maharashtra India

1. Connect to Maharashtra Transport site for HSRP plate application

https://transport.maharashtra.gov.in/ZoneWiseWebsiteRedirect.html